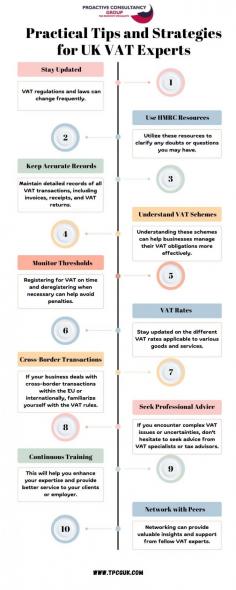

UK VAT experts benefit from staying updated with HMRC regulations and industry trends. Consistent record-keeping ensures accurate reporting and compliance. Utilize VAT software for streamlined calculations and submissions. Regular transaction reviews help identify errors and discrepancies promptly. Continuous professional development enhances expertise and keeps practitioners ahead of changes. Collaboration with peers and seeking advice when needed fosters knowledge exchange. Awareness of international VAT trends aids in anticipating UK regulatory impacts. Prioritizing client communication ensures efficient query resolution and customer satisfaction. For more, visit us at https://www.tpcguk.com/