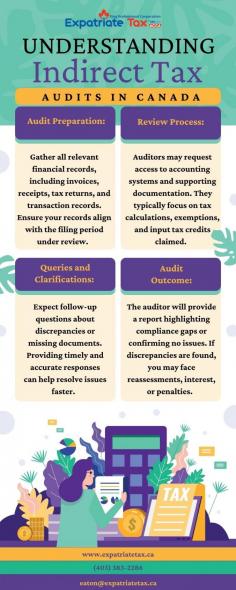

Indirect tax audits in Canada focus on taxes like GST, HST, and PST. These audits ensure businesses comply with tax regulations by reviewing financial records and transactions. Common areas of scrutiny include tax collection, reporting, and remittance. Preparing accurate documentation and proactively addressing potential discrepancies can help businesses navigate these audits and maintain compliance. Visit us at https://expatriatetax.ca/business-advisory-accounting-services/